How much gold is allowed from Dubai to India?

Gold has always been a popular commodity for investment and personal use in India. With many Indians residing in Dubai, there is often a question about how much gold can be brought from Dubai to India without attracting customs duty. Understanding this issue's regulations is crucial for individuals looking to bring gold to India from Dubai.

Dubai is popularly known as the gold town. low gold charges and excessive excellent of gold inside the UAE are the principal motives for ex-pats to purchase gold in Dubai. similarly, Dubai is a tax-loose haven, which means that you will not incur VAT or income tax while looking for gold from Dubai. however, a few years ago the central board of indirect taxes and customs set limits on the amount of gold that may be brought to India from Dubai and other emirates. permits recognize how much gold we can convey from Dubai to India and the Dubai to India gold limit.

Customs Regulations on Importing Gold from Dubai to India

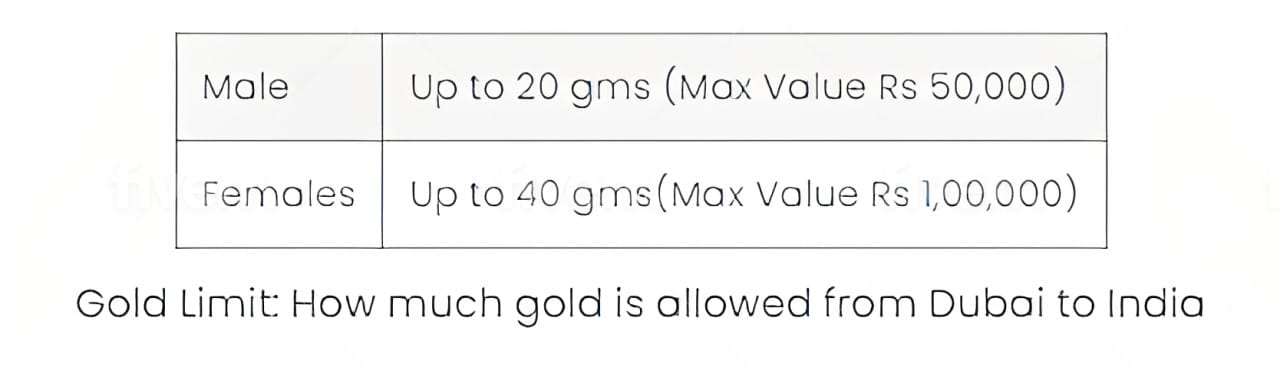

The amount of gold that can be brought into India from Dubai is subject to certain regulations set by the Indian government. As of recent updates, male passengers can bring gold jewelry worth up to INR 50,000, while female passengers can bring up to INR 100,000 worth of gold jewellery. This value is based on the cost price of the jewellery and not the retail price.

For gold bars or coins, male passengers are allowed to bring up to 20 grams with a value of INR 50,000, and female passengers can bring up to 40 grams with a value of INR 100,000. Anything above these limits will attract customs duty.

It's important to note that these regulations are subject to change, so it's advisable to check with the relevant authorities or official sources for the most up-to-date information before traveling.

Limit On Carrying Gold

If any passengers traveling from Dubai to India carry gold jewellery more than the set limit, they will have to pay a customs duty fee. but, one common question amongst humans is how a good deal of gold can I carry from Dubai to India?

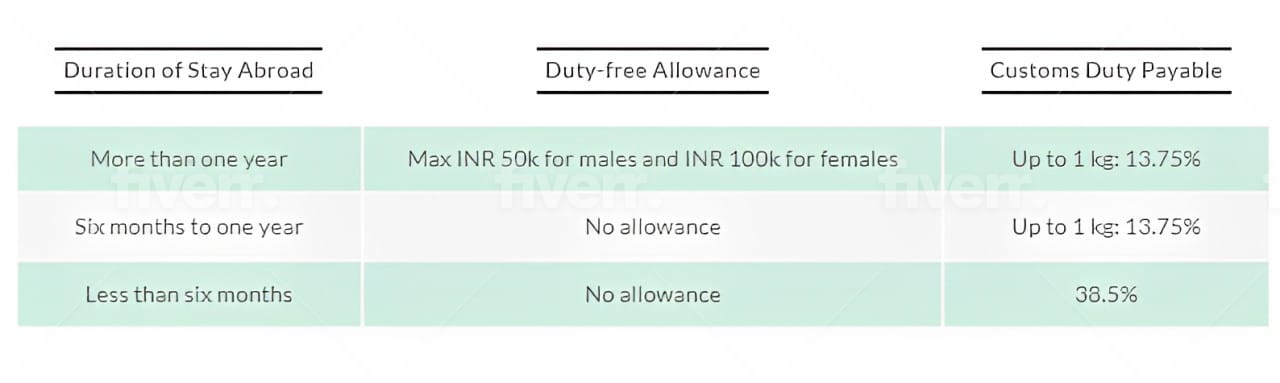

All Indian residents, who have lived overseas, or in Dubai for that count number, for more than 6 months can deliver gold coins or bars weighing up to 1 kg in their baggage while traveling to Indian. however, they may be susceptible to paying the fee charged as customs responsibility for carrying the amount of gold that exceeds the obligation-loose import restriction from Dubai to India.

Consequences of Exceeding the Allowance

If the value of the gold brought from Dubai to India exceeds the prescribed limits, passengers will be required to pay customs duty on the excess amount. The customs duty rates vary depending on the quantity and value of the gold being imported. Failure to declare excess gold or pay the applicable customs duty can lead to penalties and confiscation of the gold.

Conditions For Importing Above the Limit

⦁ The customs duty on all excess gold shall be paid in convertible foreign currency.

⦁ Passengers must provide all necessary proof of purchase and other documentation to avoid the seizure of goods at Dubai airport

⦁ Failing to meet the strict requirements and declaration may lead to detention, prosecution, or until all paperwork and documentation are complete.

⦁ Gold earrings studded with luxurious gemstones and pearls can't be imported to India.

⦁ The gold bullion and bars in Dubai need to have all of the essential inscriptions. the data has to consist of the total weight, manufacturer, and serial number.

⦁ The predominant condition for uploading gold above 1kg is that the passenger needs to no longer have introduced any gold or different treasured metals and gemstones to India within the remaining six months, exceeding the maximum gold restriction from Dubai to India.

⦁ After the fast visits to the country, the passenger can not avail of any form of exemption from paying customs responsibility on gold in India.

⦁ A passenger has to carry the gold as a piece of checked luggage, or the opposite option is to import the gold within fifteen days of their arrival in India as unaccompanied luggage.

⦁ The passenger can obtain the authorized quantity of gold from the customs bonded warehouse of the Kingdom Financial Institution of India and metals and minerals buying and selling.

⦁ The passenger should state their goal to reap gold from the customs-bonded warehouse and pay the customs obligation earlier than the clearance.

When bringing gold from Dubai to India, it is essential to be aware of the current customs regulations and limits set by the Indian government. Adhering to these guidelines will help avoid any unnecessary hassles or penalties during customs clearance.